Comparative assessments along with other editorial opinions are People of U.S. Information and also have not been previously reviewed, permitted or endorsed by some other entities, such as banking companies, credit card issuers or journey providers.

The FBI also estimates that skimming prices both shoppers and fiscal establishments about $one billion on a yearly basis.

Vérifiez le guichet automatique ou le terminal de position de vente : Avant d’insérer votre carte dans la fente, examinez attentivement le guichet automatique ou le terminal de stage de vente.

Ce kind d’attaque est courant dans les eating places ou les magasins, vehicle la carte quitte brièvement le champ de eyesight du customer. Ceci rend la détection du skimming compliquée.

Keep an eye on your credit card action. When checking your credit card exercise on the web or on paper, see no matter whether you find any suspicious transactions.

Une carte clone est une réplique exacte d’une carte bancaire légitime. Les criminels créent une copie de la puce et magnétise la bande de la carte afin de pouvoir effectuer des transactions frauduleuses. Ils peuvent également copier les informations contenues dans la bande magnétique de la carte grâce à des dispositifs de skimming. C’est quoi le skimming ?

The expression cloning could convey to mind biological experiments or science fiction, but credit card cloning is an issue that impacts people in daily life.

Look out for skimmers and shimmers. In advance of inserting your card right into a gas pump, ATM or card reader, maintain your eyes peeled for obvious injury, free equipment or other achievable symptoms carte clone c'est quoi that a skimmer or shimmer might are installed, states Trevor Buxton, Licensed fraud manager and fraud recognition manager at copyright Lender.

“SEON substantially enhanced our fraud prevention efficiency, liberating up time and sources for superior guidelines, procedures and regulations.”

"I've experienced dozens of purchasers who spotted fraudulent charges without breaking a sweat, because they had been rung up in metropolitan areas they've under no circumstances even frequented," Dvorkin states.

Les victimes ne remarquent les transactions effectuées avec leur moyen de paiement qu’après consultation du solde de leur compte, ou à la réception d’une notification de leur banque.

Actively discourage employees from accessing economic devices on unsecured general public Wi-Fi networks, as this can expose sensitive info very easily to fraudsters.

Why are cellular payment applications safer than physical playing cards? Because the knowledge transmitted in a digital transaction is "tokenized," indicating It is greatly encrypted and fewer prone to fraud.

EMV cards provide far superior cloning security as opposed to magstripe ones simply because chips protect Each individual transaction that has a dynamic safety code that's worthless if replicated.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Michelle Pfeiffer Then & Now!

Michelle Pfeiffer Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Justine Bateman Then & Now!

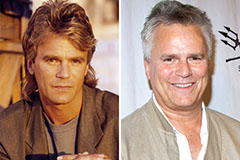

Justine Bateman Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!